The latest Safety and Shipping Review highlights the continuing positive trend in total losses, but is concerned about new critical issues arising from wars (military and commercial) and ecological transition

Today around 17% of the world’s tanker fleet belongs to the shadow fleet

According to commercial-safety-shipping-review-2025, the rapidly evolving geopolitical landscape is creating new risks and challenges for shipping, already grappling with the energy transition and the legacy of the Covid-19 pandemic.

An increasingly volatile and complex

“The industry is facing an increasingly volatile and complex operating environment, characterised by attacks on shipping, ship detentions, sanctions, as well as the consequences of incidents involving damage to critical submarine cables.

Effect of rising protectionism and tariffs

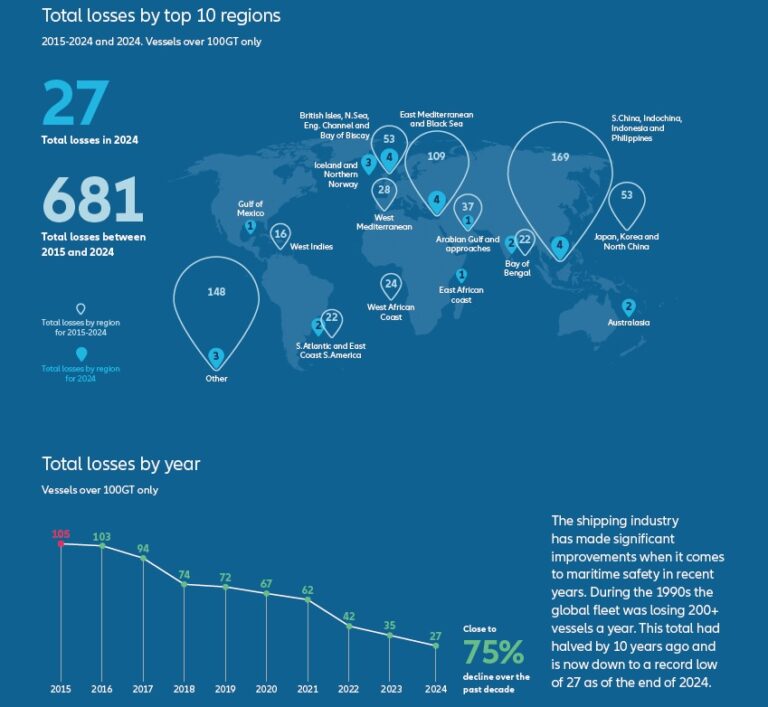

Furthermore, the domino effect of rising protectionism and tariffs threatens to reshape supply chains and disrupt established trade relationships in addition to traditional risks such as fire, collision and grounding, which are still the main causes of total losses of large vessels, although the cases are decreasing (reached an all-time low of 27 at the end of 2024)” reads a note from the insurance group.

The importance of political and conflict risk

“The importance of political and conflict risk as a potential cause of maritime losses is increasing as geopolitical tensions rise. Total losses from traditional causes have been declining over time, but we could be in a position where this positive trend is potentially offset by war and other politically-related exposures.

As an industry, we are better positioned for traditional risks, but there is a renewed focus on geopolitical risks,” said Rahul Khanna, Global Head of Marine Risk Consulting at Allianz Commercial.

The US-China trade conflict

The US-China trade conflict and the growing shadow fleet bring uncertainty and challenges. China has been the main target of the US administration’s protectionist measures, with tariffs reaching 145%, before both countries agreed to reduce them for 90 days.

Impact on global maritime trade

The developments have had a significant impact on global maritime trade, with around 18% of it subject to tariffs in mid-April 2025, up from 4% in early March, and a dramatic decline in shipments recorded immediately after the “Liberation Day” announcements. While the future of US trade policies remains uncertain, another phenomenon is posing a growing challenge to the shipping and insurance industry: the shadow fleet.

Increasing Shadow fleet

Since the start of the war in Ukraine, the size of the shadow fleet has increased significantly. Today, it is believed that around 17% of the world’s tanker fleet belongs to the shadow fleet, with estimates indicating that there are nearly 600 tankers trading only Russian oil. Ships in the shadow fleet have been involved in dozens of incidents around the world, including fires, collisions and oil spills.

Related : Ukraine seizes one of Russia’s “shadow fleet” ships

A major risk to maritime safety and the environment

“The shadow fleet continues to pose a major risk to maritime safety and the environment, as many of them are likely to be older, poorly maintained and inadequately insured vessels. In the event of an oil spill involving a shadow fleet tanker, the cleanup costs could be as high as $1.6 billion, most likely borne by taxpayers,” says Justus Heinrich, Global Product Leader, Marine Hull, Allianz Commercial.

Related : Saudi company denies about Houthi attack on its ship in Red Sea

Fires on large ships

Fires on large ships continue to be a major concern for insurers. Seven total losses were reported across all ship types in 2024, the same number as the previous year. The overall number of incidents increased year-on-year, reaching a 10-year high of 250, again across all ship types. Around 30% of these fires occurred on container, cargo or roll-on roll-off (Ro-Ro) ships (69). Over the past decade, more than 100 ships have been lost due to fires.

Efforts are underway to mitigate these risks,

Efforts are underway to mitigate these risks, with regulatory changes and technological advances aimed at tackling cargo misdeclaration, a major cause of such fires. This is crucial as the electrification of the global economy poses further challenges, given the growing number of lithium-ion batteries and battery energy storage systems being carried.

“There is no doubt that the shipping industry is becoming more resilient to the risks associated with large vessels, although it is by no means under control. However, only 27 total losses in 2024 underscore the positive trend.

To put this into context: the global fleet is over 100,000 vessels (over 100 GT). However, uncertainty and multiple risks persist. Cyber attacks and GPS interference are on the rise. Ceasefires have raised hopes, but the security threat in the Red Sea and supply chain disruption are likely to remain. In the meantime, the ecological transition requires a lot of work. The next few years will be decisive and will determine the path of the industry and global trade,” Khanna concludes.

What are Insurance Types to Consider?

Cyber Insurance

Environmental Liability Insurance

Climate Change & Weather-Related Coverage

War Risk Insurance / Political Risk Insurance

Pandemic-Related Insurance (P&I with pandemic clauses)

Green Technology Insurance

Bio-Fouling Management Insurance (or Premium Reduction Incentive)

Supply Chain Disruption Insurance

Crew Health Insurance

Autonomous Ship Insurance

Geopolitical Risk & Sanctions Insurance