The global liner fleet has reached 30 million teu for the first time ever, according to Alphaliner, with a tsunami of teu in Asia bringing record numbers of new ships this year.

According to data promptly collected by the research and analysis company Alphaliner, the global fleet of container ships has reached and exceeded 30 million TEUs for the first time in history; this thanks to the enormous hold capacity put into the water in the first months of the current year by the Asian shipyards.

The pace of growth of the global container fleet is remarkable: it took the industry around 50 years to reach the 5 million TEU threshold in 2001 while the leap from 20 million to 30 million TEU was achieved in just seven years.

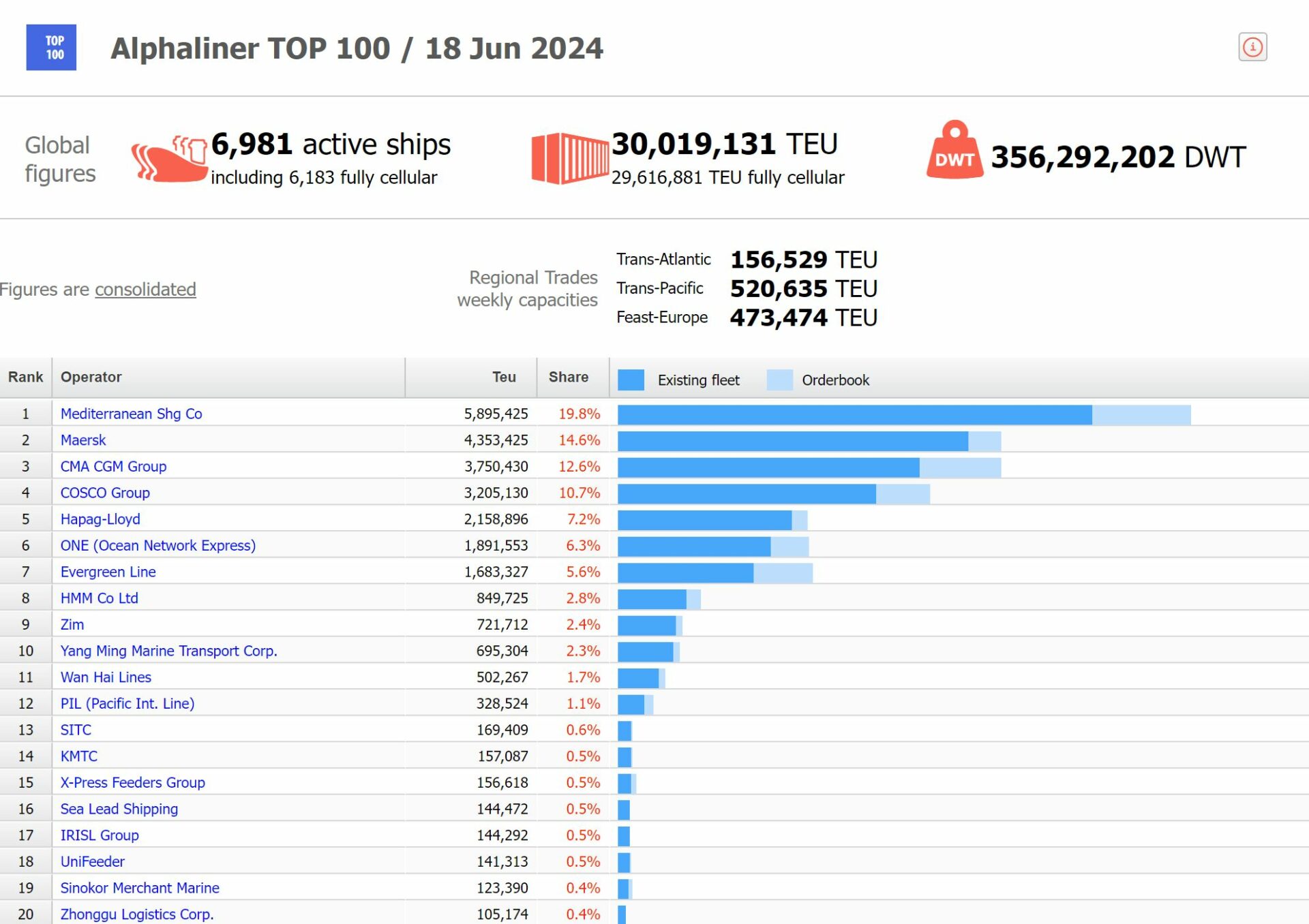

As shown in the graph on the page, the top three maritime carriers in terms of hold capacity offered (i.e. MSC, Maersk and CMA CGM) control 47% of the existing container ship fleet, while the top five operators account for 64.9% of the storage capacity. hold available and in the top ten 84.3% of the TEUs on the market.

According to the Bimco association, the delivery of 478 container ships with a capacity of 3.1 million TEUs is expected this year, a value 41% higher than the record of 2023. As a result, the capacity of the container fleet is expected will increase by 10% in 2024.according to BIMCO

The move from the 30 million to 35 million TEU capacity threshold is expected to be very rapid as Asian shipyards continue to win orders, with some of the largest builders reportedly contracting deliveries of container ships scheduled until 2029. “There is a ‘enormous amount of negotiations underway for new construction,’ broker Braemar noted in his latest report on container markets as reported by Splash247.

Bimco also highlights that the shipyards’ global order book currently stands at 133 million compensated gross tonnage (CGT), an increase of 56 million CGT compared to the most recent low recorded at the end of 2020. Gas tankers and container ships have covered 35% and 30% of the increase respectively

As ship orders continue to pour into Asian shipyards, the pace of the rise from 30 to 35 meters is expected to be very rapid. Reports this week said some of the best-known names in China’s shipbuilding industry currently have contracts for charter deliveries through to 2029.

The global orderbook for shipyards now stands at 133 million compensated gross tonnes (cgt), an increase of 56 million cgt from the orderbook’s recent low point at the end of 2020, according to shipping body BIMCO. LNG and containerships account for 35% and 30% of the increase, respectively.