The classification society explains how and why the Alternative Fuels Directive is a complete and well-designed economic policy intervention

Fuel per year between 2030 and 2034 without action will increase from €5.6 million in 2030 to €7.2 million in 2034.

FuelEU represents a major economic policy intervention by the EU, pushing shipping companies to increase the adoption of renewable and low-carbon fuels by setting requirements on the greenhouse gas (GHG) intensity of all fuels.

A recent Lloyd’s Register report on the subject supports this.

Today, many shipowners and operators are concerned about the EU Emissions Trading System (ETS), designed to reduce emissions from shipping. However, LR projections show that the impact of FuelEU will exceed that of the ETS around 2035 and will dwarf it in the years thereafter. Business as usual is therefore no longer an option and progressive decisions must be taken to address this challenge.

The FuelEU regulation aims to promote more sustainable fuels, through a system of significant penalties for shipping companies that do not make the transition.

Ships of 5,000 GT or more must reduce the greenhouse gas intensity of their fuels by 80% by 2050 compared to a benchmark set in 2020 or face penalties.

This change will be gradual, with small initial targets that will increase as we get closer to 2050, as will the level of action needed to comply.

A view of the EU

The EU has a view on each of the different fuels available to shipping companies, resulting in a hierarchy.At the top, with the greatest benefits, are Rfnbo (Renewable fuels of a non-biological origin), produced by combining green hydrogen with other elements such as carbon or nitrogen extracted from the atmosphere. At the bottom, fossil fuels carry the greatest penalties. Somewhere in the middle are biofuels, produced from biological sources.

Fines and an annual multiplier

Without any action, ships using the same HFO/MGO mix as today will be subject to fines and an annual multiplier. Fines for a fleet of five ships, each using 5,000 tonnes of fuel per year between 2030 and 2034 without action (well-to-wake intensity is 91.40 gCO2eq/MJ) will increase from €5.6 million in 2030 to €7.2 million in 2034.

This hypothetical fleet

This hypothetical fleet of five vessels could follow several routes to become compliant. This analysis considers two credible routes for 2034: the first involves increasing proportions of biodiesel; the second a similar fleet but with increasing proportions of bioLNG in a single dual fuel LNG vessel.

Biofuels were chosen

These two biofuels were chosen not because they are “better” – they will not be appropriate or even relevant for many fleets – but because they are “drop-in” fuels, both are usable because they are already available and use existing shipping infrastructure.

EU’s Fit For 55

As other parts of the EU’s Fit For 55 regulatory package come into force, more alternative fuels will become available, presenting strategies that are better suited to a wider range of fleets. Beyond 2035, cost forecasts become very uncertain, as they depend on a multitude of emerging factors, including the supply of RFNBO and how these fuels are priced by the EU.

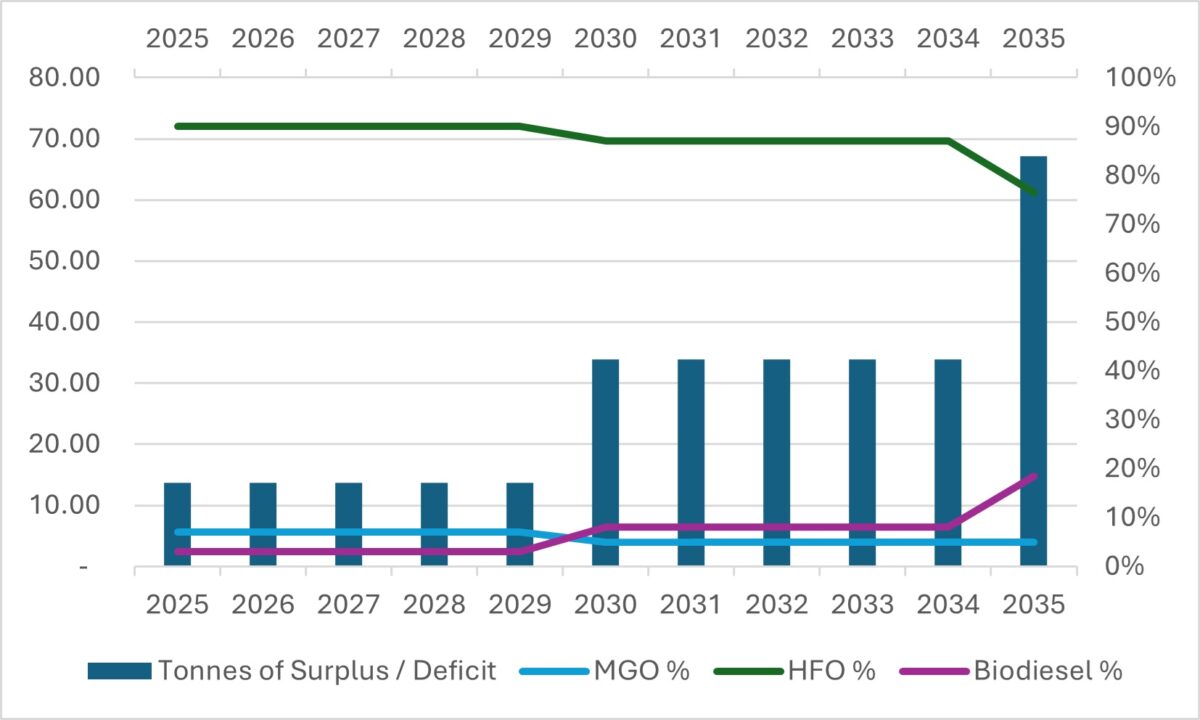

This chart shows

This chart shows how a single vessel using 5,000 tonnes of HFO-equivalent fuel per year can maintain FuelEU compliance by increasing the share of biodiesel in its fuel mix every five years, to 3% from 2025, 8% from 2030 and then 19% from 2035. This scenario produces a small compliance surplus, measured in tens of tonnes per year.

Small fleet

In this small fleet of five ships, each ship would need to adopt this strategy for the entire fleet to be compliant.

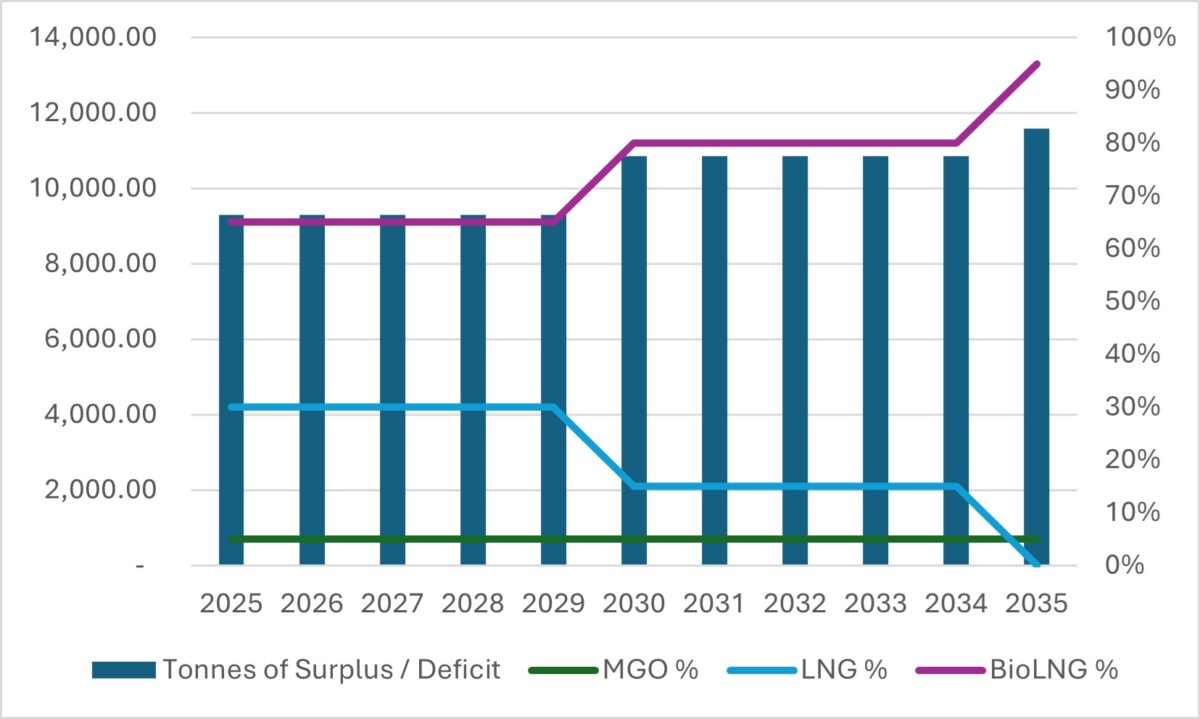

In scenario 2, we see how the FuelEU pooling element can work within a fleet. Taking the same fleet of five ships, four operate as usual on a 90% HFO/10% MGO blend. The fifth ship uses a blend of LNG and bioLNG, with the bioLNG percentage rising to 95% by 2035.

Given equal compliance, the pooling mechanisms in the regulation mean that in this example the surplus of one bioLNG vessel covers the deficits of the other four vessels in the fleet, making the entire fleet compliant until 2034 as the bioLNG share increases.

The bioLNG vessel has a compliance surplus of 9,287 tonnes in 2025, rising to 11,576 tonnes in 2035, compared to just 67 tonnes in the biodiesel example. Increasing the biodiesel share in the previous example could result in larger surpluses.

In this example, the compliance surplus is initially so large that one vessel covers the compliance deficit of 17 similar vessels each year between 2025 and 2029, which could then be purchased by third parties or potentially a secondary market at some point in the future.

This surplus is reduced to five vessels between 2030 and 2034 as FuelEU tightens, before only covering itself in 2035. Further action would then be needed to bring the remaining vessels into compliance.

ELNG, an Rfnbo From 2035

From 2035 onwards, one option could be to switch to eLNG, an Rfnbo, which is expected to have a lower greenhouse gas intensity than bioLNG, but, as the figures for eLNG have not yet been set in the second phase of the EU Renewable Energy Directive and this fuel is not yet produced in significant quantities, it is difficult to make accurate projections.

FuelEU rewards

In any case, these examples demonstrate a basic principle: FuelEU rewards those who are over-compliant by creating a new market in which to sell the surplus of compliance. While every intervention entails a cost, it can also generate a return. And the returns can be significant.

If a tonne of CO2 equivalent emissions can be worth at least €500 on the free market and you can save, for example, 7,500 tonnes of CO2 equivalent emissions per year, you can see how this can quickly become a significant revenue driver.

New directives in the EU and US

There are further benefits to compliance. New directives in the EU and US require companies to manage their indirect emissions, those produced by their value chain, which will inevitably include shipping.

Shipping companies that procrastinate will therefore not only face fines and the need to buy excess compliance, but may also see their revenues decline as their customers switch to low-carbon competitors.

Rrom fossil fuels to low-carbon emissions.

The economy will shift from fossil fuels to low-carbon emissions. FuelEU cannot be seen as just an imposition, but as a major economic policy intervention that shipping companies with ships operating in European waters must work with to build a profitable and sustainable future.

Source : shipping Italy

Read more :

Columbia Group solutions FuelEU Maritime rules for Shipowners