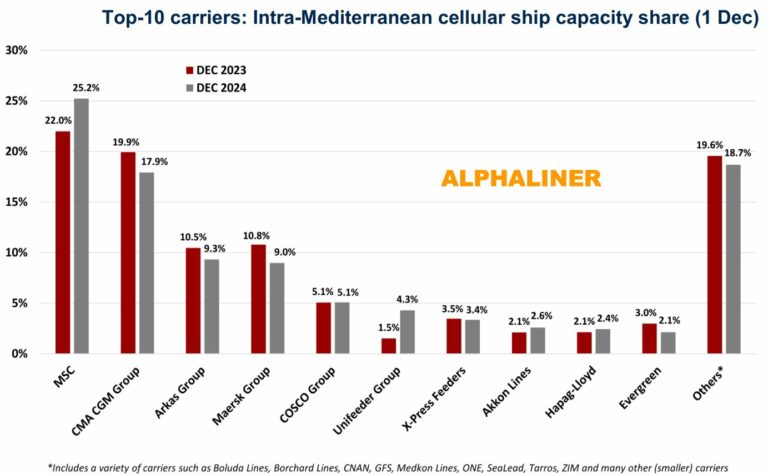

MSC carrier exceeds 25% of the total hold capacity, to the detriment of, among the big ones, Maersk, Cma Cgm and Evergreen, while Hapag Lloyd resists and grows (but less). The biggest leap is by Unifeeder

Intra-Mediterranean container transport is increasingly concentrated in the hands of MSC This is illustrated by a graph recently released by the analyst Alphaliner, which shows the evolution in one year of the shares of this market held by the top ten maritime carriers compared to December 2023.

The intra-Mediterranean service

Overall, the capacity of the intra-Mediterranean service grew by 9.3%, or almost 50,000 TEU, compared to December 2023, as carriers deployed more ships (368 versus 345) of slightly larger average size (1,499 TEU versus 1,463 TEU) in the Mediterranean.

Than 3 percentage points

MSC grew by more than 3 percentage points, breaking through the 25% mark. This is offset by the losses in share recorded by other primary operators in the Mediterranean container market, such as CMA CGM ,ARKAS and MAERSK while in fifth place COSCO holds on with 5.1%.

Climbed five places

Unifeeder has climbed five places over the year to sixth place in the ranking of the largest Mediterranean operators by capacity deployed. The Aarhus-based carrier had a market share of 4.3% as of December 1, compared to just 1.5% in 2023. With an expanded capacity of 24,000 TEU, Unifeeder is now almost the same size as the Chinese liner giant’s Mediterranean fleet.

Alphaliner highlights

Alphaliner highlights how “mainline operators continue to dominate the Mediterranean market segment, with an overall market share of 65%, leaving 35% to regional carriers and common feeder operators”. Among the big players, Hapag Lloyd is slightly up, from 2.1% to 2.4%.