There are four foreseeable scenarios: in the worst case scenario, the current situation will continue until 2026

Longer transit times and ‘time to market’, more expensive shipping prices and logistics to be reorganised. One year later, these are the impacts that the Red Sea crisis has had on global trade, quadrupling transport costs compared to October 2023 according to the research and analysis company BCG Shipping Italy reported

Houthi attacks

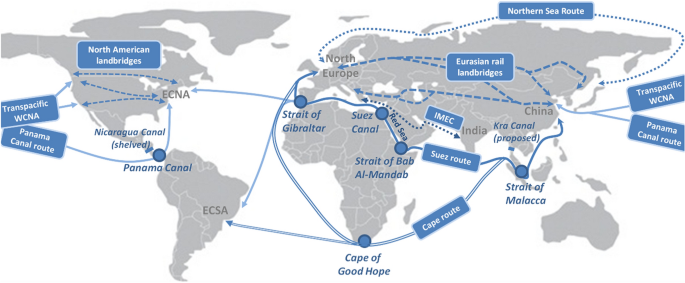

Houthi attacks along the Bab el-Mandeb Strait, where 12% of world trade and 40% of goods between Asia and Europe transit, have made this route difficult to navigate, forcing shipping companies to divert ships through the Cape of Good Hope and increasing transit times up to 10 days.

Scenarios white paper

A new white paper entitled ‘What’s Next for Container Shipping in the Red Sea Crisis’ just published by BCG updates the scenarios already outlined last March, identifying new challenges and opportunities that the sector must face in this critical phase.

Invest in resilience strategies

“The prolongation of the Red Sea crisis confirms how vulnerable the global logistics system is to geopolitical crises, leading the industry to the need to invest in resilience strategies” states Gabriele Ferri, managing director and partner of BCG

Scenarios-for-Container-Shipping-in-the-Red-Sea-Crisis

Future of trade routes

He underlines that “the future of trade routes between Asia and Europe depends on the industry’s ability to adopt more flexible and adaptive approaches, diversifying transport options, investing in new technologies to enable dynamic optimization of routes and prices and improving the overall efficiency.

Develop long-term solutions

At the same time, for producers, it is necessary to develop long-term solutions, such as the (total or partial) relocalization of production and greater integration between maritime and air transport to ensure operational continuity.”

Increase in transport times

The scenario in which trade routes were diverted to the Cape of Good Hope has led, according to BCG to a 30% increase in transport times and an increase in shipping rates up to seven times compared to pre-crisis levels.

The new paper just published does not envisage rapid improvements but, on the contrary, predicts that the crisis could continue until 2026, with further impacts on global trade.

Ports the hardest hit

Ports along Saudi Arabia‘s western coast, such as Jeddah and King Abdullah Port, are among the hardest hit, with a drastic reduction in transshipment activity. In contrast, some alternative ports, such as those in Dubai, Mundra in India, and Columbo in Sri Lanka, have benefited from an increase in maritime traffic, but the pressure on infrastructure remains high

The ports of the Mediterranean, especially those located in the eastern part, have suddenly become peripheral to the main Asia – Europe route which previously crossed Suez canal and now circumnavigates Africa.

The global economic consequences

The research states that, regarding the global economic consequences, the latest estimates confirm that the solutions adopted by shipping companies, such as increasing capacity and speeding up ships, are now exhausted.

“Traffic across the Red Sea has suffered a sharp decline, while transport rates have risen dramatically” they say from BCG although in reality in recent months freight rates for container shipments have almost halved compared to the first half of 2024.

A 20-foot container

A 20-foot container from China to Italy today pays less than $3,000 but the research in question highlights that “companies face unsustainable operating costs and longer delivery times, compromising the continuity of global supply chains” .

Attempts to diversify routes

The paper analyzes attempts to diversify routes through corridors such as India-Middle East-Europe, routes which however do not offer immediate solutions to reduce delays.

Even the use of air freight

Even the use of air freight, which has seen an increase in shipments from Asia to the UAE for distribution in Europe, fails to offset the impact on low-value, high-volume goods, which rely primarily on sea freight .

The first “Quiet End”

BCG therefore offers an update with four possible scenarios. The first, ‘Quiet End to Turbulent Year’, is seen as increasingly distant and expects attacks to taper off this autumn following sporadic Western responses combined with the Houthis’ depleting supplies. Containers largely return to the Red Sea, but normal shipping will not resume until 2025.

The second “Military Escalation”

The second, ‘Military Escalation’, involves the intensification of Houthi attacks and a major military response by Western forces.

After an initial military escalation, the conflict could end in 2025, with a slow recovery of trade within the year. In this scenario, shipping companies could diversify routes to avoid future similar crises, with a moderate shift towards alternative trade corridors.

The third “Muddling Through”

The third, ‘Muddling Through’, sees the attacks continue until 2026, albeit in a reduced form. The Allied forces would not be able to find a definitive solution and the crisis would remain limited to the Red Sea. However, insecurity would continue to cause moderate economic losses, with a partial shift of trade routes towards alternative routes.

The fourth “Regional Crisis”

The fourth, ‘Regional Crisis’, foresees a complete expansion of the conflict, which would involve the entire Arabian Peninsula. The Bab el-Mandeb would be permanently closed and all maritime traffic would be diverted to the Cape of Good Hope. In this context, shipping costs would increase further and the region would suffer a significant economic impact, with a 2% reduction in transport demand from the Far East to Europe and a 1% contraction in global GDP.

Read more :

Red Sea Crisis : Competition of Salalah ,Djibouti and Jebel Ali ports

Houthi naval capabilities after 234 days of the Red Sea Crisis !

Egypt in the storm of geopolitical challenges for Red sea region

Sea-Intelligence discusses the container crisis and its effects