Donald Trump‘s return to the White House will refocus the nation’s energy policy onto maximizing oil and gas production and away from fighting climate change, but the Republican win in Tuesday’s presidential elections is unlikely to dramatically slow the U.S. renewable energy boom. according to Reuters

A Biden-era law

That is because a Biden-era law providing a decade of lucrative subsidies for new solar, wind and other clean energy projects would be near-impossible to repeal, thanks to support from Republican states, while other levers available to the next president would only have marginal impact, analysts say.

“This is well underway.”

“I don’t think a Trump president can slow the transition,” said Ed Hirs, Energy Fellow at the University of Houston. “This is well underway.”

Renewable energy sources

Renewable energy sources like solar and wind are the fastest growing segments on the power grid, according to the Department of Energy, driven by federal tax credits, state renewable energy mandates, and technology advancements that have lowered their costs.

Fight climate change.

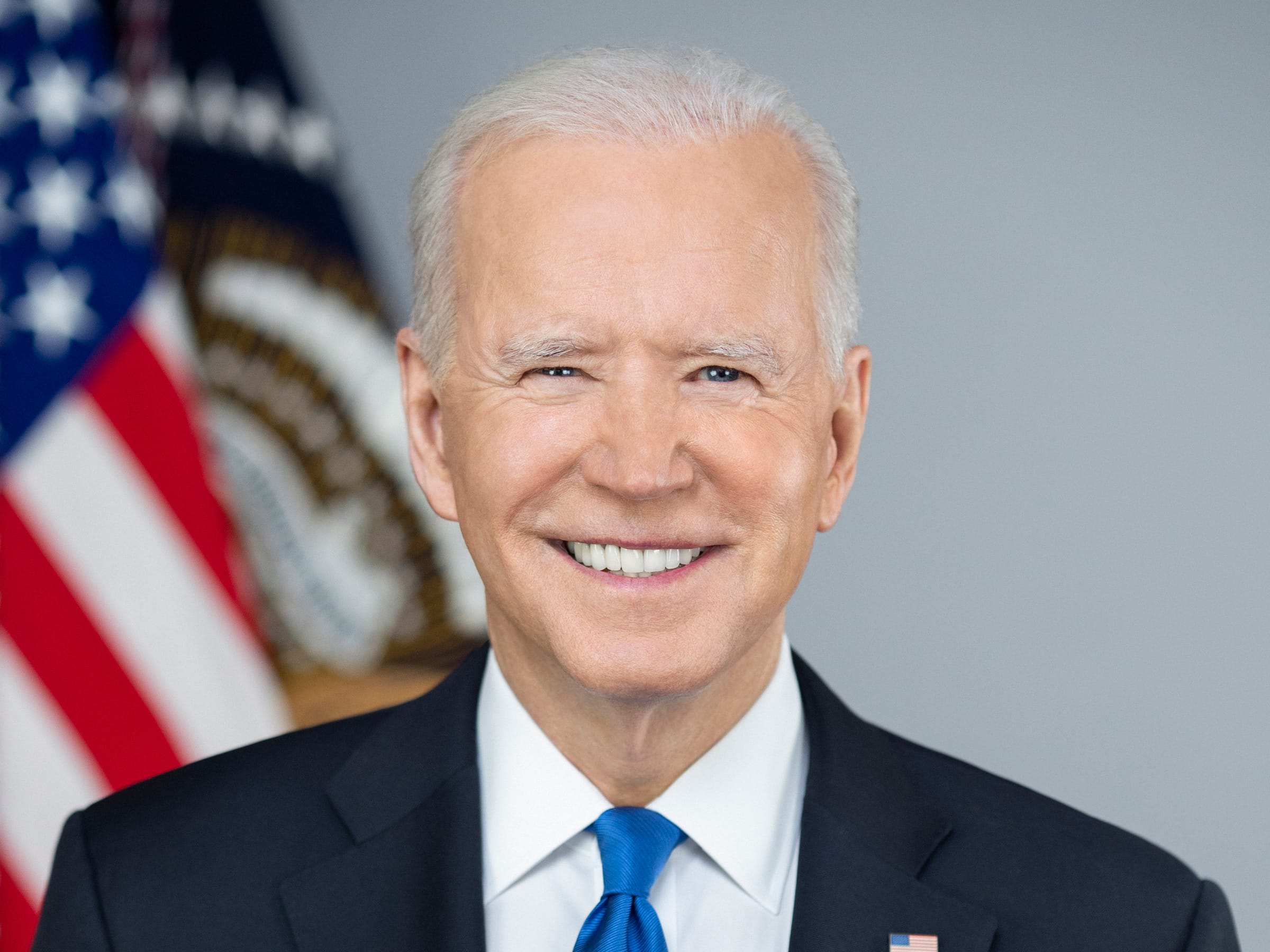

President Joe Biden in 2022 signed into law the Inflation Reduction Act guaranteeing billions of dollars of solar and wind subsidies for another decade as part of his broader effort to decarbonize the power sector by 2035 to fight climate change.

IRAs-related investments

Before the election, Trump slammed the IRAs as being too expensive and promised to rescind all unspent funds allocated by the law – a threat that, if accomplished, could pour cold water over the U.S. clean energy boom.

But doing so would require lawmakers, including those whose states have benefited from IRAs-related investments like solar panel factories, wind farms and other projects, to vote to repeal it.

Clean energy technologies

Many of Trump’s allies also benefit from the IRAs through their investments in clean energy technologies, Reuters has previously reported.

Fleming said Trump could, however, slow things down around the margins by hindering federal agencies that deliver IRAs grants and loans, or by reducing federal leasing for things like offshore wind.

Biden administration

The Biden administration has rushed to ensure it spends the majority of available grant funding under the IRAs before a new president arrives, Reuters has previously reported.

Offshore wind industry

“I think you would see more preference given to fossil fuel extraction on public lands and waters,” said Tony Dutzik, associate director and senior policy analyst at Frontier Group, a non-profit sustainability think tank.

That could have an outsized impact on the offshore wind industry, which aims to site projects in federal waters. Most onshore solar and wind projects are located on private property, as is the vast majority of oil and gas drilling.

Poses a threat to whales!

Trump has said he intends to end the offshore wind industry “on day one,” arguing it is too expensive and poses a threat to whales and seabirds, a dramatic policy reversal after his first administration supported offshore wind development.

Offshore wind lease sales.

Bernstein Research said Trump is likely to enact a moratorium on new offshore wind lease sales.

Meanwhile, U.S. fossil fuel production is likely to look much the same under Trump, experts said. The U.S. has already become the world’s largest oil and gas producer, under the watch of Biden, thanks to a drilling boom in fields like the Permian Basin under Texas and New Mexico.

Trump paved the way for the boom

Trump paved the way for the boom by slashing red tape during his term in the White House and he could expand U.S. fossil fuel production in a second term by rolling back Biden’s climate initiatives, his campaign said. Trump could, for example, push for drilling in Alaska’s Arctic National Wildlife Refuge.

Blocked ANWR drilling

Biden blocked ANWR drilling leases, but even if Trump opens up the pristine area prized by environmentalists, it is uncertain whether companies would be willing to pump in the rugged north.

“Presidents can make a lot of noise about plans for U.S. oil and gas, but ultimately it’s individuals and companies responding to prices of a global commodity that make the decisions on when to drill,” said Jesse Jones, head of North American Upstream at Energy Aspects.

(Reuters – Reporting by Richard Valdmanis; editing by Timothy Gardner, Marguerita Choy and David Evans)

Read more :

US EPA :3$ billion grants funded for 55 applications in Clean Ports

DNV : Finance initiative for eight US offshore wind developments

Houthi naval capabilities after 234 days of the Red Sea Crisis !

Egypt in the storm of geopolitical challenges for Red sea region

Sea-Intelligence discusses the container crisis and its effects