Despite now more than half a year on from the beginning of the Red Sea crisis, the severe impact on the container shipping industry continues unabated.Sea intelligence reported

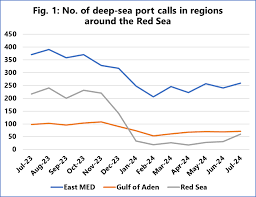

Figure 1 shows the number of deep-sea port calls in the major regions closest to the Suez Canal – East Mediterranean (East MED), Gulf of Aden, and the Red Sea itself.

Drop in total number

While the total number of monthly deep-sea port calls in East MED was already trending downwards per-crisis, the M/M drop in January 2024 was quite significant at -22%. Compared to the pre-crisis average, the drop in 2024 has been -33%. A similar -33% drop in the average monthly calls was also seen for the Gulf of Aden, from roughly 100 monthly calls to 60-70 in 2024.

Recovering very Slowly

Like East MED port calls in the region have been recovering, albeit very slowly. The Red Sea saw the most severe impact of the crisis, with a -85% drop in the average number of deep-sea port calls in 2024. The figure dropped from over 200 calls per month, to under 40 in January-June 2024.

Saudi Ports

The figure rose to 60 calls in July 2024, which was double that of the previous months. However, it remains to be seen if this will continue, or if this is a temporary uptick.

In the Red Sea, the most impacted ports were Jeddah and King Abdullah Port. Carriers stopped calling King Abdullah Port on their deep-sea services from January 2024 onwards, while Jeddah saw the sharpest decline of -74% M/M from December 2023 to January 2024.

Egypt in the storm of geopolitical challenges for Red sea region

Slight improvement

Even after a slight improvement in July 2024, the port is averaging just 37 calls per month compared to the pre-crisis average of 135 monthly calls.

In East MED, Piraeus and Port Said were the most impacted, while in the Gulf of Aden, Salalah saw deep-sea port calls drop by nearly -50% in January-February 2024.

Three regions

In terms of schedule reliability, Red Sea and East Mediterranean are back to the per-crisis levels, while the Gulf of Aden is still lagging.

Additionally, an improvement was recorded across all three regions in the average delay of late vessel arrivals, which, after a very sharp increase to 10-14 days in January 2024, dropped back down to pre-crisis levels of 4-5 days.