The merchant fleet headed by US interests would be the fourth in the world in terms of value, behind the Chinese, Greek and Japanese ones

Cruise ships are the most valuable type of ship in the U.S. fleet, with a combined value of $60.1 billion

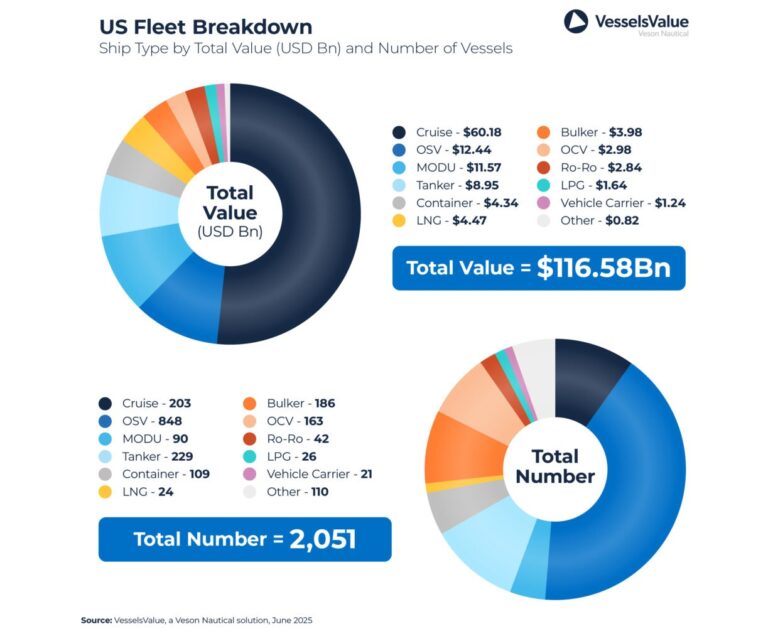

VesselsValue has taken an indepth look, using its data, at the US fleet broken down by vessel type, the top 10 shipowning nations, and the current market value of all vessel types compared with the historic median.To mark the start of 2025 Marine Money Week in New York, VesselsValue has taken an indepth look, using its data

According to an analysis by Veson Nautical dedicated to international shipping, the merchant fleet headed by US interests would be the fourth in the world Cruise sector represents bulk of US$116Bn US fleet in terms of value , behind the Chinese, amounting to US$271Bn Greece ranks third with a fleet value of US$183Bn. and Japanese ones,with a fleet value of US$230Bn with a value of 116.5 billion dollars Japan’s strength in bulk carriers, Greece’s in tankers

he cruise sector remains the most important maritime resource of the Country, strengthening the position of the United States as the main cruise ship owner in the world. This is predictable, given that the two main cruise companies, Carnival and Royal Caribbean, are based in the United States” explains the Veson report.

Cruise ships are the most valuable type of ship in the U.S. fleet, with a combined value of $60.1 billion; they are also the second-largest fleet by volume, with 203 ships. The cruise industry has seen a significant increase in value this year, particularly for older ships. This comes amid strong demand for the industry, and at the same time, many ships have been demolished or retired during the pandemic, resulting in a shortage of second-hand vessels.

The offshore support vessel (OSV) sector ranks second with a value of $12.4 billion. However, in terms of volume, this sector ranks first, representing the majority of the US fleet with a share of about 35.5%. Third place goes to the MODU (Mobile Offshore Drilling Unit) sector with a value of $11.6 billion and a fleet of 90 vessels.

Oil tankers are in fourth place, with a value of $8.9 billion and the third largest fleet, consisting of 229 vessels. New arrivals to the fleet this year include six Chinese-built VLCCs, approximately 300,000 DWT and between 9 and 10 years old, purchased by International Seaways from Ocean Yield for approximately $257.7 million 90 vessels

According to Bancero Costa data, prices of new tankers and on the secondary market increased significantly in the second half of 2024 and remained the same in January 2025. This is the result of an increase in demand for tankers in shadow fleets and the extension of oil and product transport routes.

The container sector ranks fifth, with a value of $5.4 billion and 109 vessels. This sector has seen a significant increase in value over the past year, with increases in almost all subsectors and age groups, due to the crisis in the Red Sea. For example, the value of 15-year-old, 2,500 TEU sub-panamax vessels increased by approximately 63.24% year-on-year, from $17.71 million to $28.91 million.

Despite some market weakness due to geopolitical factors and economic uncertainty, asset values remain stable across all sectors, relative to the 10-year historical median. In particular, the PSV and AHTs sectors, where vessels over five years old are 163% and 155% above the 10-year historical median, respectively. The container sector is also noteworthy, with values of vessels over five years old up 110% relative to the 10-year historical median.

Marine asset values will remain stable in 2025, driven by limited shipyard capacity, strong demand for second-hand vessels and ongoing geopolitical tensions. With newbuilding opportunities limited and regulatory uncertainty discouraging new orders, buyers are increasingly choosing modern, green tonnage. Extended trade disruptions have lengthened voyage times and reduced supply, supporting profits and helping to stabilize asset values despite lower freight rates.

The U.S. fleet reflects this broader market strength and diversity, with cruise ships standing out as the most valuable segment, highlighting the industry’s stability in a challenging environment.

Related: Global fleet of container ships exceeded 30 million TEUs

Source More Sources