According to Seatrade Cruise the first ship should be priced just over $500 million.

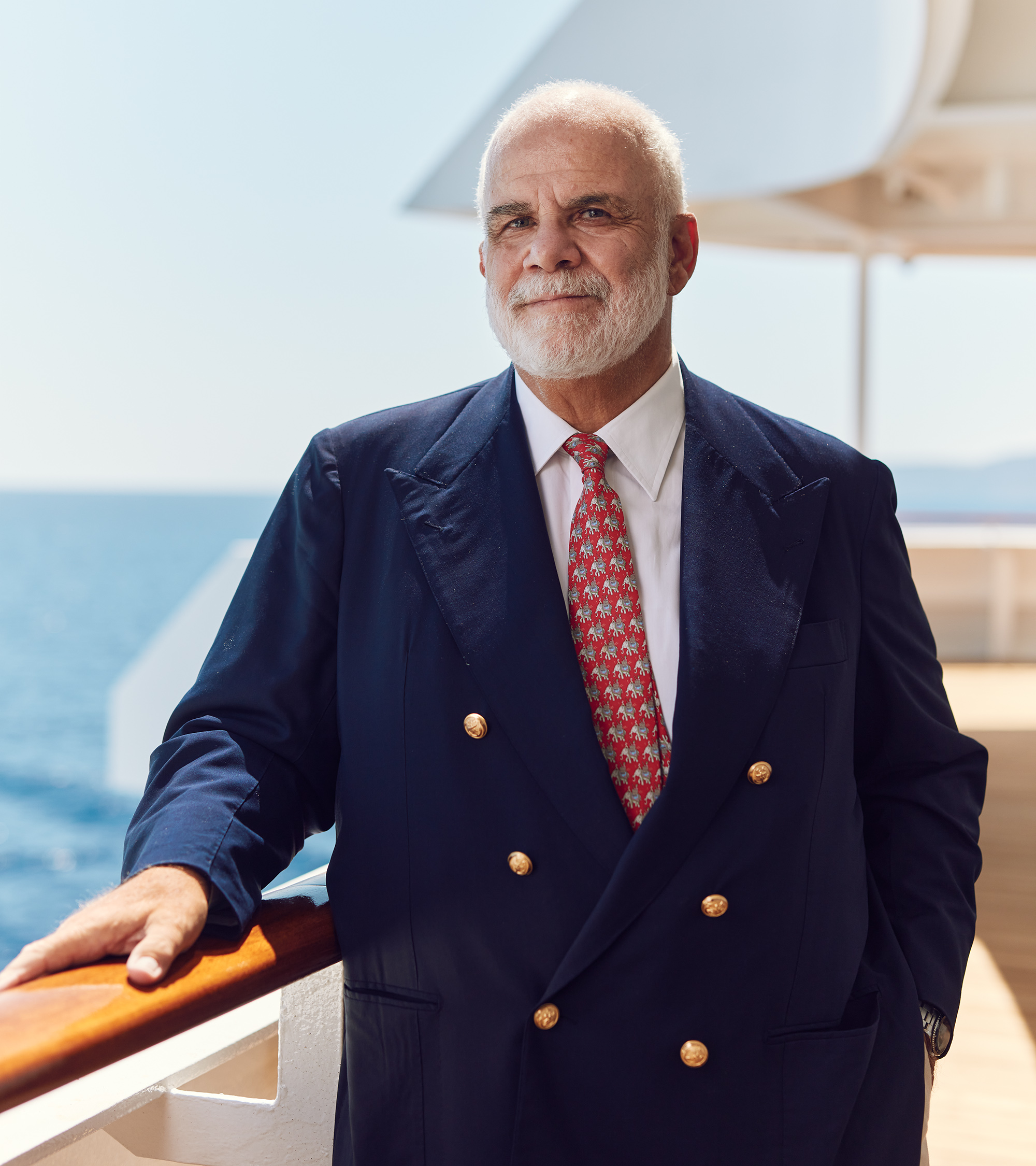

Crystal Cruises has obtained a line of credit, supported by Sace’s export credit system, to finance the purchase of the two new ships under construction commissioned to Fincantieri. “Receiving this financing represents a decisive step forward in Crystal’s expansion and demonstrates the strong confidence of the market in our strategy,” said Manfredi Lefebvre d’Ovidio, executive chairman of A&K Travel Group, parent company of Crystal Cruises.

The pool of credit institutions is led by Citibank, joined by Banco Santander, CaixaBank, Cassa Depositi e Prestiti, Credit Agricole Corporate and Investment Bank, Banca Monte Dei Paschi Di Siena and Bper Banca. Crystal has been advised by Clifford Chance, while Norton Rose Fulbright acted for both the lenders and SACE.

The shipowner has acknowledged and highlighted the “essential contribution” of Cassa Depositi e Prestiti and Simest in structuring this complete financing package.

A first order for these new units of 61,500 gross tons and 650 passengers capacity (all suites) was announced in June 2024 with delivery scheduled for May 2028 while for the second newbuilding the debut is not yet specified. Crystal has subsequently exercised the option for a third newbuilding, with delivery indicatively scheduled for 2032.

Prices for these new builds have not been disclosed but according to Seatrade Cruise the first ship should be priced just over $500 million.The first ship is expected to be delivered in May 2028, with the second vessel expected in 2030.

Related : Fincantieri and Crystal Cruises Forge Partnership with MoU