Global trade has been surprisingly resilient, despite the volatile trade policy environment. Air cargo came to everybody’s rescue as a critical enabler of rapid adaptation, ensuring that goods arrived ahead of announced tariff deadlines

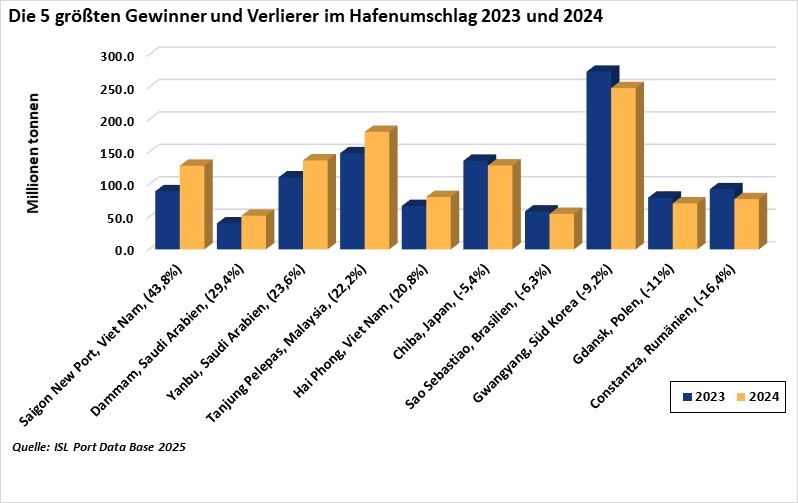

The total cargo throughput of the 470 ports recorded in the ISL Ports Database increased by 3.4% in 2024, following a 0.5% increase in 2023. This translates to an average growth rate of 1.7% over the past ten years, with significant differences between continents. Global container throughput reached a record high of 792 million TEU in 2024, representing a 7.5% increase compared to 2023 and an average growth rate of 2.6% since 2014. The highest growth rates for total and container throughput were recorded in Africa and South America.

Two-thirds of the Asian market

More than half of the world's 23 billion tons of cargo handled in Asia were processed through ports. The four largest port countries – China, South Korea, Japan, and India – accounted for two-thirds of the Asian market, with shares of 42.3%, 10.9%, 6.5%, and 5.7% respectively, recording a combined throughput of 8 billion tons in 2024. Cargo throughput in the leading East Asian markets developed differently. While China, India, and South Korea increased by 3.2%, 2%, and 0.9% respectively, Japanese ports declined by 0.3% and 0.3% respectively.

In Europe, the 146 ports handled 3.4 billion tonnes of goods in 2024

In Europe, the 146 ports listed in the ISL port database handled 3.4 billion tonnes of goods in 2024, an increase of 1.7% compared to 2023, slightly above the 2014 figure. This represents an average annual growth of 0.1% over the last ten years, while disruptions along the routes through the Suez Canal and the Red Sea caused schedule fluctuations and interruptions to feeder networks.

In Africa, the 69 ports handled 1.3 billion tons of cargo

In Africa, the 69 ports recorded in the ISL port database handled 1.3 billion tons of cargo, representing 5.3% of the total throughput of all 470 ports recorded worldwide. This represents a 7.2% increase compared to 2023. In North America, the 69 recorded ports handled 2.61 billion tons of cargo, a 10.6% increase compared to 2023.

In the 50 South American ports

The total cargo volume of 1.4 billion tons handled in the 50 South American ports was four times higher than in Central America, reflecting the dominance of large export ports for dry bulk cargo in South America. Transshipment plays a significant role in the Central American market, which experiences regular shifts in market share. In 2024, Lazaro Cardenas saw a 28.8% increase to 2.40 million TEU, following a 7.8% decrease in 2023.

The global freight market in 2026

On the other hand the global freight market in 2026 is emerging as a "transition year" characterized by a mixture of continued, moderate growth in volume, significant overcapacity, and intense pressure to digitize, resulting in a generally positive, albeit "busy but not consistently healthy" landscape. While not experiencing a full, demand-driven boom, the sector is avoiding a crash by shifting toward resilience, sustainability, and technological integration, according to industry forecasts for early 2026.

Air cargo is playing an increasingly central role in the growing trade in AI-related goods

According to IATA Global trade has been surprisingly resilient, despite the volatile trade policy environment. Air cargo came to everybody’s rescue as a critical enabler of rapid adaptation, ensuring that goods arrived ahead of announced tariff deadlines and facilitating the swift rerouting of China’s exports to alternative markets. Air cargo is also playing an increasingly central role in the growing trade in AI-related goods. While trade growth may slow in 2026, air cargo is well-positioned to remain robust, benefiting from AI-driven investment, growing demand for high-value, time-sensitive goods, and the structural shift toward e-commerce. In times of uncertainty, when speed matters most, air freight remains the preferred option. As a result, air cargo traffic is projected to grow by 2.6% in 2026.

AI : Divert investment away from critical climate solutions.

While artificial intelligence and the associated trade flows are an opportunity for air cargo, it is much less helpful for the global energy transition. Growing electricity demand from data centers is increasing competition for limited renewable energy, making it harder to secure affordable inputs for Sustainable Aviation Fuel (SAF). Without coordinated policy to prioritize renewables and safeguard liquid fuel needs, this could delay aviation’s decarbonization and divert investment away from critical climate solutions.

Europe is set to deliver the highest net profit,

Regionally, Europe is set to deliver the highest net profit, very much thanks to Turkey’s stellar performance. The Middle East is the region with the highest profit margins. Asia Pacific is where growth is the most rapid, and Latin America shows signs of structural improvement. North America faces new headwinds, including stagnating domestic demand and operational constraints, yet it remains a key contributor to industry profitability.

Related : Alphaliner : The evolution of container shipping over the last 25 years in numbers- Details

#IATA # Global trade #Air cargo #AI #Global container #ISL #470 ports #Europe # global freight market # Africa#South America.

You Might Also Like

Recommendation News

Marine Tech

IACS announces next Chair Alex Gregg-Smith 22 January 2026

Yachts&Cruises

Tensions in the Persian Gulf force Costa to cancel cruises to UAE 08 October 2025

Yachts&Cruises

Stena Line and ABP : Commence work new freight ferry terminal at the Port of Immingham 28 November 2025

Marine Cultures

Cartons with Sakhraoui Tarek Caricaturiste 24 January 2026

Shipping Lines

Hapag-Lloyd Confirms Advanced Talks On Acquisition Of ZIM Integrated Shipping Services Ltd. 16 February 2026